Starting a business is an exciting journey filled with innovation and opportunities. However, it also comes with multiple challenges, particularly in tax management. Navigating the complexities of tax regulations can be overwhelming for startups. Outsourcing tax services to specialized companies can be a game-changer, providing expertise, ensuring compliance, and reducing the fiscal burden. Studies have shown that external tax advisors bring independence and specialized knowledge, enhancing reporting quality and mitigating tax risks (Cullinan & Zheng, 2017; Höglund & Sundvik, 2016). This article delves into the benefits of outsourcing tax services for startups, exploring how such services can drive compliance and growth and offering guidance on choosing the right tax company.

Research indicates that using services from outsourced tax payment and compliance expert firms helps startup companies lower risks, manage finances with greater precision, and improve service levels. For startups operating with limited resources, these benefits of outsourcing tax management are particularly valuable. Tax compliance is a complex and ever-changing landscape, and for US startups, keeping up with the latest tax laws and regulations across different states can be especially challenging.

Outsourcing tax services to specialized firms ensures that all tax-related activities are managed by professionals who stay current with state-specific laws. Outsourced tax management significantly reduces the risk of non-compliance, which can lead to severe penalties and legal issues. Expert outsourcing firms ensure accurate and timely tax filings, protecting startups from potential financial and reputational damage.

Studies have shown that outsourcing tax management services allows companies to effectively navigate various tax challenges, including frequent changes in tax rules and regulations. For startups that often lack in-house expertise, this is crucial for ensuring compliance and avoiding penalties.

Tax laws are complex and regularly evolving, with varying tax regulations across different regions. By outsourcing, startups access a pool of tax experts with specialized knowledge and skills. These companies of professional tax attorneys provide strategic tax planning advice, help identify relevant tax credits and deductions, and optimize tax strategies to reduce liabilities. This level of expertise is typically beyond the reach of a startup without the resources to hire full-time, in-house tax professionals.

Recommended:Most Common Bookkeeping Mistakes

Hiring and maintaining an in-house tax team can be relatively inexpensive for startups, which typically operate on tight budgets. Outsourcing tax services allows startups to access high-quality expertise without facing the overhead costs of full-time employees. This cost efficiency helps startups allocate resources to critical business areas, such as product development, marketing, and growth initiatives. Additionally, taxing outsourcing firms often provide scalable services, allowing startups to adjust their level of support as their taxing needs evolve.

Research has shownthat outsourcing tax work allows firms, including startups, to concentrate on their core strengths, such as financial analysis and client relationship management. The strategic move of outscouring tax work is particularly beneficial for new businesses trying to establish themselves in the market.

Managing taxes by an in-house team can be time-consuming and divert valuable resources from core business activities. Startup founders and key personnel often wear multiple hats, and the added burden of tax management can detract from their primary responsibilities. By outsourcing tax services, startups can focus on innovating, developing products, and expanding their market presence. Strategic allocation of resources taxing firms helps startups maintain a competitive edge and drive growth.

Recommended: Outsourced Accounting for Startups

Startups often experience rapid growth and changing needs. Outsourcing tax services provides the flexibility to scale services up or down based on the business’s current requirements. Whether a startup needs extensive support during tax season or ongoing service throughout the year, outsourcing firms can customize their services to meet these taxing needs. Customized tax adaptability is crucial for startups that may face fluctuating demands and varying levels of complexity in their financial operations.

Tax errors can seriously affect audits, penalties, and reputational damage. Outsourcing to a specialized tax firm reduces these risks by ensuring accuracy and compliance. These taxing firms employ strong processes and advanced technologies to manage tax filings and documentation, reducing the possibility of errors. In the event of an audit, having an experienced tax firm on the startup side can provide crucial support and representation, helping the enterprise to navigate the audit process smoothly and efficiently.

Beyond compliance and filing, tax outsourcing firms offer valuable advisory services that can contribute to strategic financial planning. These professional tax attorneys can provide insights into cash flow management, help develop long-term tax strategies, and advise on optimal business structures to minimize tax liabilities. This strategic guidance can be instrumental in driving a startup's financial health and growth.

Outsourcing firms using advanced software and technologies to simplify tax processes, ensuring that all filings are accurate and timely. These tools also facilitate better record-keeping and data management, which are essential for compliance and audit readiness. By automating routine tasks and reducing manual errors, outsourcing firms improve the overall efficiency of tax management, allowing startups to operate more smoothly.

Recommended: Accountants vs Bookkeepers

Taxing outsourcing firms offer a wide range of services beyond basic tax filing. These services include payroll services, financial planning, audit support, and more. By partnering with a full-service business consultancy firm, startups can benefit from integrated solutions that address their financial needs. This complete support ensures that all financial operations are matched and optimized, contributing to the business's overall success.

One of the most significant benefits of outsourcing tax services is the peace of mind it provides to startup founders and managers. Knowing that tax compliance and strategy are in the hands of experts allows startup leaders to focus on their vision and business goals without the constant worry of tax issues. Peace of mind assurance can lead to better decision-making and a more confident approach to business growth.

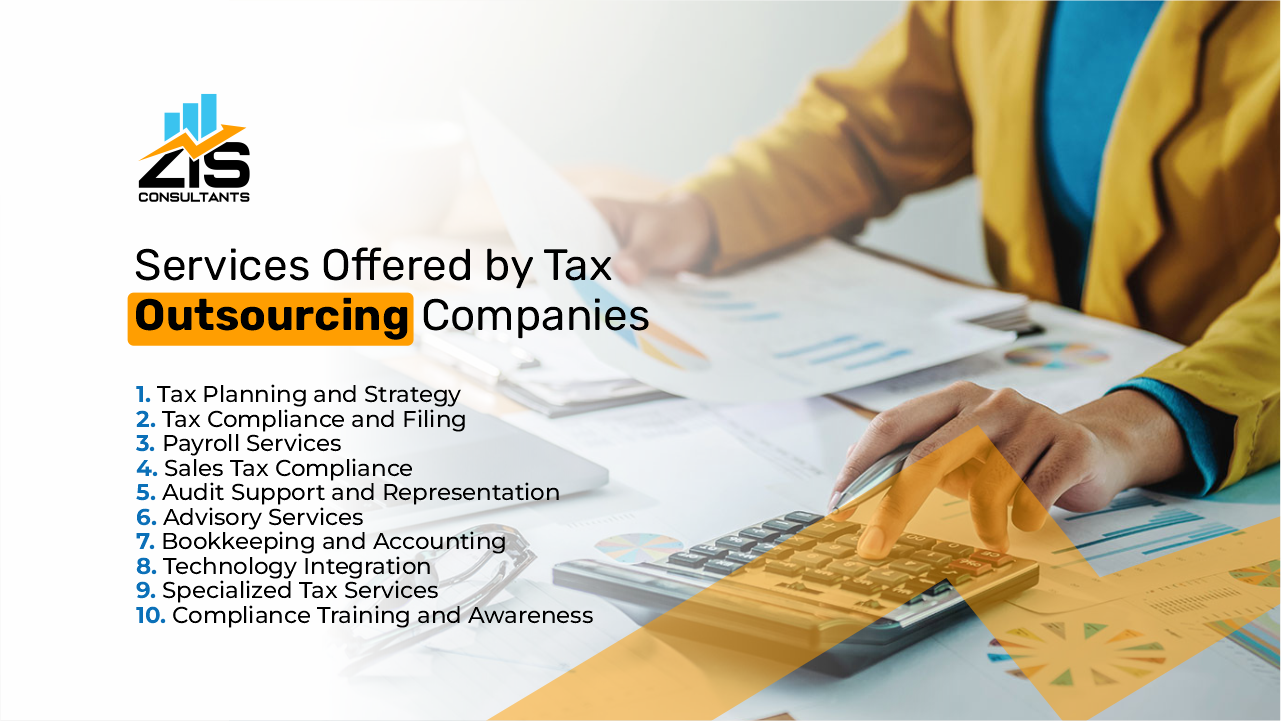

Tax outsourcing companies provide a wide range of services customized to meet the specific needs of startups. By using the expertise of these taxing firms, startups can navigate the complex landscape of tax management with ease and efficiency. Here’s a detailed look at the services typically offered by tax outsourcing companies:

Tax outsourcing companies help startups with complete tax planning, which involves developing long-term strategies to minimize tax liabilities and maximize savings. External tax consultants provide proactive tax advice, offering insights on potential tax benefits, credits, and incentives while staying ahead of changes in tax laws to adjust strategies accordingly. Additionally, tax compliance partners conduct scenario analysis to predict tax outcomes under different financial situations, guiding startups in making significant financial decisions to optimize their tax positions.

Recommended: Best Way to Track Expenses for Small Business

Compliance with tax regulations is crucial for startups, and tax outsourcing companies excel in this area by preparing and filing federal, state, and local tax returns accurately and on time. Tax handling agencies handle all necessary documentation, ensuring everything is completed correctly to avoid penalties. These tax strategy expert companies also manage deadlines for quarterly and annual tax filings, ensuring timely submission of tax returns. They stay updated with the latest tax regulations to ensure compliance and handle any required amendments or corrections to previously filed taxes.

Managing payrolltaxes is critical for startups, and tax outsourcing firms provide complete payroll processing services, including calculating and disbursing employee payments and ensuring correct tax withholdings. Tax solution providers also handle payroll tax filings, ensuring all returns are filed accurately and on time, and manage year-end forms such as W-2s and 1099s. These companies ensure compliance with federal, state, and local payroll tax requirements by keeping up-to-date with employment tax laws and regulations.

Tax outsourcing companies help startups with sales tax compliance by registering the business for sales tax in relevant regions and managing multi-state sales tax obligations. Tax compliance specialists prepare and submit sales tax returns, ensuring timely payments to avoid interest and penalties. Additionally, these third-party tax firms conduct bond studies to determine tax obligations in various states and advise on compliance with sales tax laws across multiple jurisdictions.

Recommended:Cost of Outsourcing Bookkeeping Services

In the event of a tax audit, tax outsourcing companies provide invaluable support by preparing necessary documents and records and organizing financial records to ensure readiness. Specialized tax firms represent the startup during tax audits, communicating with tax authorities on behalf of the business. Post-audit, they address any issues or differences identified and implement recommendations to prevent future audit issues.

Tax outsourcing companies offer strategic financial planning advice to support business growth, including developing financial forecasts and budgets. Outsourced tax experts provide cash flow management advice to optimize working capital and guide startups on the tax implications of business expansion, mergers, acquisitions, and international tax considerations. This holistic approach helps startups make informed financial decisions that align with their long-term goals.

Day-to-day bookkeepingand accurate financial record-keeping are essential services tax outsourcing companies provide. External tax consultants handle daily financial transactions, maintain organized records, and prepare financial statements such as income statements, balance sheets, and cash flow statements. By ensuring compliance with accounting standards and reconciling bank statements and other financial accounts, they help startups identify and correct discrepancies in their financial records.

Recommended:Benefits of Outsourcing Bookkeeping

Modern tax management relies heavily on technology, and tax outsourcing companies help startups by implementing and integrating accounting software solutions and training staff to use these tools. Outsourced tax experts automate routine tax processes to improve efficiency and accuracy, reducing manual errors. Additionally, these firms prioritize data security, implementing robust protection measures to safeguard sensitive financial information and comply with data privacy regulations.

Tax outsourcing companies offer specialized services customized to industries such as tech, healthcare, retail, and cannabis, understanding the unique tax challenges and opportunities within different sectors. Tax management agencies manage international tax obligations for global startups, providing cross-border tax strategies and compliance advice. They also handle indirect tax services, including VAT, GST, and other taxes, ensuring worldwide compliance with indirect tax regulations.

To ensure ongoing compliance, tax outsourcing companies develop and deliver tax compliance training programs for startup employees, educating them on relevant tax laws and regulations. Professional tax advisors provide continuing support and updates on tax compliance requirements, ensuring the startup remains informed about changes in tax legislation.

Recommended:Will Bookkeeping Be Automated?

Zis Consultants specializes in providing comprehensive tax and accounting services tailored for startups. They offer expert guidance on tax compliance, financial planning, and regulatory requirements. Known for their personalized approach and in-depth understanding of startup needs, Zis Consultants is an ideal partner for new businesses navigating the complex tax landscape.

Wipfli offers a range of tax outsourcing services, leveraging technology and industry expertise to help startups manage their tax obligations efficiently. Wipfli services ensure that startups remain compliant while optimizing their tax strategies.

PwC is a global leader in tax services, offering comprehensive solutions tailored for startups. PricewaterhouseCoopers expertise spans across various industries, providing strategic tax planning, compliance, and advisory services to help startups thrive.

Renowned for their payroll processing and compliance services, ADP provides robust software solutions for managing payroll taxes efficiently. They offer comprehensive support to help startups navigate tax compliance issues, making them a trusted partner in the industry.

Crowe's deep industry knowledge and customized tax solutions make them a valuable partner for startups. They offer services that include tax planning, compliance, and advisory, helping startups manage their tax obligations with ease.

Gusto specializes in payroll, benefits, and human resources solutions. Their integrated platform simplifies tax filings and compliance for startups, and they are known for their user-friendly interface and comprehensive support services.

Grant Thornton offers customized tax services to help startups manage complex financial landscapes. Their expertise in tax strategy, compliance, and advisory services supports startups in navigating their financial obligations effectively.

EY offers a broad spectrum of tax services, including advisory and compliance. Their tailored approach helps startups navigate complex tax landscapes efficiently, providing the necessary support for financial growth and stability.

Recommended:Questions to Ask a Bookkeeper

Specializing in middle-market businesses, RSM provides tax outsourcing services tailored to startups. Their comprehensive approach includes tax planning, compliance, and advisory services, ensuring startups receive the support they need to grow.

KPMG provides specialized tax outsourcing services with a focus on innovation and technology. Their offerings include tax planning, compliance, and advisory services, making them a strong choice for tech startups looking to navigate the tax landscape effectively.

Forvis Mazars offers comprehensive tax solutions with a global reach and local expertise. Their services include tax planning, compliance, and advisory, supporting startups in managing their international tax obligations.

Plante Moran provides a full suite of tax services with a focus on personalized client service. Plante Moran offerings include tax planning, compliance, and financial advisory, making them a trusted partner for startups aiming to achieve financial stability and success.

Recommended:Do I Need a Bookkeeper?

Specializing in tax services for startups and growing businesses, Cherry Bekaert provides tailored solutions that include tax planning, compliance, and advisory. Their focused approach helps startups navigate the intricacies of tax management effectively.

CLA is known for its personalized approach and deep industry expertise. CLA offer a wide range of tax and accounting services to help startups achieve their financial goals, providing tailored support for complex tax needs.

CBIZ provides a full range of tax services with a focus on small and emerging businesses. Their offerings include tax planning, compliance, and financial advisory, making them an excellent choice for startups seeking comprehensive tax management solutions.

Immedis is a global provider of payroll and mobility tax services, offering solutions for sales tax compliance and business technology. Known for its expertise in handling complex tax regulations, Immedis provides tailored solutions to meet the unique needs of startups.

Recommended:What to Look for in Bookkeeper

Armanino is known for its innovative approach and tailored tax solutions for startups. Armanino's services include tax planning, compliance, and advisory, providing startups with the necessary tools to manage their financial health and growth.

EisnerAmper offers outsourced accounting, finance, tax, and advisory services, focusing on supporting early-stage startups with their financial and compliance needs. Known for its strategic advisory services, EisnerAmper helps startups achieve growth-oriented goals.

Renowned for their tax consulting and compliance expertise, Deloitte is an ideal partner for growing businesses. Deloitte offer a wide range of services, including tax strategy, audit support, and financial advisory, ensuring startups are well-supported in their financial journeys.

Known for their personalized approach, BDO has extensive experience working with startups. BDO services include tax planning, compliance, and financial advisory, making them a reliable partner for startups seeking expert tax management.

Selecting the right taxing company to outsource startup tax services is a crucial decision for any startup. The right outsourced tax experts can help startups guide complex tax regulations, ensure compliance, and provide strategic financial advice, all essential for a startup's growth and success. Here's a detailed guide on how to choose the right taxing company for startup:

Look for a taxing company with experience in your startup-specific industry. Tax regulations can vary significantly across different sectors, and an experienced firm will understand the unique challenges and opportunities relevant to business.

Research the company’s history and track record. A firm with a proven history of helping startups succeed is likely to be a good choice. Check for client testimonials, case studies, and references.

Ensure that the firm’s tax professionals have the necessary certifications and qualifications. This includes credentials like CPA (Certified Public Accountant) or EA (Enrolled Agent).

Recommended:Outsourcing Bookkeeping Overseas From USA

Choose an outsourced tax experts firm that offers a full range of tax services, including tax planning, compliance, filing, audit support, and advisory services. All tax-related services under one roof ensure startups have a one-stop solution for all startup tax needs.

Tax compliance outsourcing firms should be able to customize their services to meet startup-specific needs. Startups' unique requirements differ from those of established businesses, so flexibility is key.

Ensure the dedicated tax consultants firm uses up-to-date software and tools that integrate smoothly with your startup’s existing systems. Ensuring firms are up-to-date includes accounting software, payroll systems, and other financial tools.

Tax management depends heavily on technology. The right outsourced taxing company should employ advanced tax preparation, filing, and compliance tools. Modern solutions not only improve accuracy but also enhance efficiency.

With the rise of cyber threats, data security is paramount. Ensure the tax compliance outsourcing firm implements strong security measures to protect sensitive financial information.

Look for firms that leverage automation and artificial intelligence to streamline processes and provide deeper insights into your financial data.

Understand the pricing structure of the taxing firm. Look for transparent pricing models with no hidden fees. Transparent pricing could be a flat fee, hourly rate, or a percentage of the tax savings achieved.

While cost savings are a significant benefit of taxing outsourcing, assessing the value provided by the tax management firm is crucial. Paying a bit more for a reputable firm can save startups more money in the long run through optimized tax strategies and error-free filings.

Ensure that the services offered fit within your startup’s budget. Discuss any potential additional costs upfront to avoid surprises.

Effective communication is key to a successful outsourcing partnership. Choose a firm that offers strong customer support and maintains clear, consistent communication channels.

Ensure that the tax compliance firm is accessible and responsive. You should be able to reach out to them easily with any questions or concerns and expect timely responses.

The specialized tax firm should respond to CEOs/founders' queries and provide proactive advice. They should keep startup management informed about tax law changes and how tax changes might impact your startup.

Consider whether the taxing firm’s working style matches your company culture. A good cultural fit can improve collaboration and ensure a smoother working relationship.

As a startup grows, Growing business tax needs will become more complex. Ensure that the firm has the capacity to scale its services to match startup growth.

Check the firm’s reputation in the market. Positive reviews and references from other startups can provide confidence in their capabilities.

Ensure that the firm adheres to all regulatory standards and ethical guidelines. This is crucial for maintaining compliance and avoiding legal issues.

The firm should offer audit support services. In case of an audit, having a knowledgeable team on your side can be invaluable.

Startups can benefit significantly from well-implemented tax strategies that maximize savings and ensure compliance. Here are several effective tax strategies that startups can employ to optimize their financial resources:

Many governments offer tax incentives to promote entrepreneurship and support startups. These can include research and development (R&D) credits, investment credits, and hiring credits. Researching and identifying which incentives are available in your region is essential.

Ensure startups apply for all applicable tax credits. For example, the R&D tax credit can provide substantial savings for startups developing new products or technologies. These credits can reduce startup tax liability, freeing up capital for reinvestment in business.

Maintaining accurate and detailed records of all business expenses is crucial. Proper classification ensures that a startup can take full advantage of available deductions. Categories include office supplies, marketing costs, travel expenses, and equipment purchases.

A tax professional can help ensure startup expense classifications are accurate and compliant with current tax laws. Accurate expense classifications will maximize startup deductions and reduce the risk of audits.

Familiarize yourself with the tax-deductible business expenses. Common deductions include office rent, utility, employee salaries, and marketing expenses. Deducting these expenses can significantly reduce startup taxable income.

If CEOs operate their startup from a home office, a startup may be eligible for a home office deduction. Home office deduction allows CEOs to deduct a portion of their home expenses, such as mortgage interest, utilities, and insurance, proportional to the space used for business.

The structure of a startup business can have a significant impact on tax liabilities. Common structures include sole proprietorships, partnerships, limited liability companies (LLCs), S corporations, and C corporations. Each has different tax implications.

Work with a tax advisor to determine the most tax-efficient structure for your startup. Tax compliance outsourcing firms can help you understand the benefits and drawbacks of each entity type and choose the one that aligns best with your business goals and financial situation.

Tax laws are constantly evolving. Regularly review changes in tax regulations to ensure the startup remains compliant and takes advantage of any new deductions or credits. Staying informed helps CEOs adjust startup tax strategies as needed.

Consider subscribing to tax news updates or newsletters from reputable sources. Signing up for tax newsletters will inform CEOs and startup management about significant tax law changes that could affect business.

Modern tax software can simplify the process of tax filing and ensure accuracy. These tools can help track expenses, calculate deductions, and prepare tax returns efficiently.

Ensure your tax software integrates seamlessly with your accounting systems. This integration can streamline startup financial management and ensure consistency in your records.

Many startups are required to pay estimated taxes quarterly. Failing to do so can result in penalties. Calculate your estimated tax payments accurately to avoid underpayment penalties.

Regularly set aside funds to cover your estimated tax payments. This practice ensures you have the necessary resources available when payments are due, avoiding financial strain.

Setting up retirement plans for yourself and your employees can provide tax benefits. Contributions to retirement plans, such as a Simplified Employee Pension (SEP) or a 401(k), are often tax-deductible.

Maximizing contributions to these plans can reduce your taxable income. Additionally, offering retirement plans can help attract and retain top talent.

Hiring certified public accountants (CPAs) or tax advisors who specialize in startup taxation can be invaluable. External tax consultants can provide expert guidance, ensure compliance, and help optimize your tax strategy.

Regular consultations with your tax professionals can help you stay on top of tax obligations and make informed financial decisions. Specialized tax firms expertise can identify opportunities for savings and growth.

A long-term tax plan should align with your business goals. This plan should consider potential growth, expansion into new markets, and future tax liabilities.

Regularly review and adjust your tax plan to adapt to changes in your business and tax laws. This proactive approach ensures your tax strategy remains effective over time.

Incorrectly classifying expenses can lead to missed deductions and increased tax liabilities. Ensure that all expenses are accurately recorded and classified.

Failing to file taxes on time or submitting inaccurate returns can result in penalties and interest charges. Outsourcing can help ensure timely and accurate filings.

In addition to federal taxes, startups must also comply with state and local tax regulations. An outsourcing partner can help manage these diverse requirements effectively.

Poor record keeping can lead to difficulties in tax preparation and increased audit risk. Maintain detailed and organized records of all financial transactions.

The future of tax outsourcing lies in the integration of advanced technologies such as AI and machine learning. These technologies can automate routine tasks, improve accuracy, and provide deeper insights into financial data.

As startups grow, their tax needs become more complex. Tax outsourcing firms will increasingly offer advisory services that go beyond compliance, helping startups with strategic financial planning and decision-making.

With the rise in cyber threats, data security will become a top priority for tax outsourcing firms. Startups should choose partners that implement robust security measures to protect sensitive financial information.

The demand for customized tax solutions will grow as startups seek partners that can address their unique needs and challenges. Outsourcing firms will need to offer flexible and scalable services to meet these demands.

Outsourcing tax services can be a game-changer for startups, providing them with the expertise and resources they need to manage their tax obligations effectively. By choosing the right tax outsourcing partner, startups can ensure compliance, achieve financial efficiency, and focus on their core business activities, setting a solid foundation for growth and success.